9 min to read

Data Driven Finance

Dawn of Data Science & Reforming Finance

The emergence of Data Science in the recent past was stated and quoted by many influential figures in the world as the equivalent of “discovering fire in the 21st century”. More over the Harvard Business Review mentioned the designation of Data Scientist as the sexiest job of the 21st century.

Citation from Harvard Business Review:

Davenport, Thomas H., and D. J. Patil. “Data Scientist: The Sexiest Job of the 21st Century.” Harvard Business Review 90, no. 10 (October 2012): 70–76.

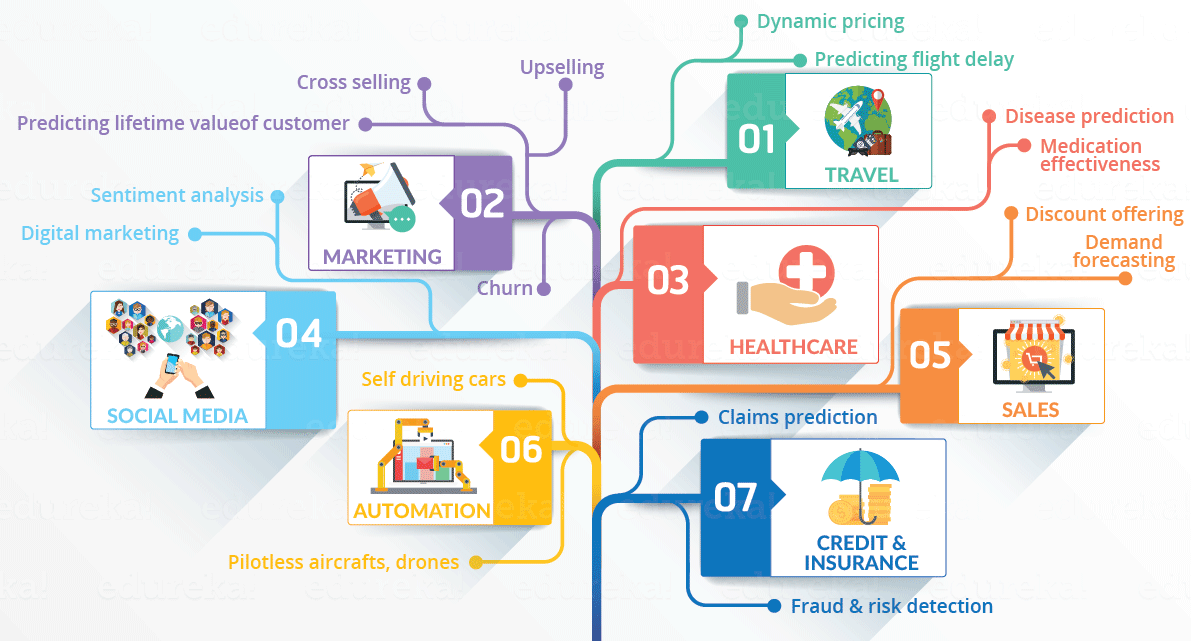

Since the emergence and prevalence of the field of Data Science, it has revolutionized and boosted many industrial domains such as:

- Finance

- Healthcare

- Manufacturing

- Transport

Even though significant influence brought in by Data Science over these fields, many more fields other than these domains (such as Sports, Environmental Science etc.) are impacted and transmuted by data science for sure. In this article we will mainly be looking into how data science have injected new blood into the domain of data science in revolutionizing major aspects of finance that were challenging and exigent before.

Traditionally finance was just looked as crunching number and balancing statements. But now it has come to a time where finance is no longer just about numbers, but about code as well. As matter of fact when looking in retrospect finance has always been about data. For instance, before the birth of the data science and a specific field of expertise, finance industry has been using some of these analytical techniques used in data science for certain tasks. How banks were using automated risk analysis is one such instance.

But now the use of data science has become a core component of this domain and data the hub of its functioning. Data Science has become an integral cog of this hive of financial elements facilitating processes such as risk analytics, customer management, fraud detection, and algorithmic trading.

But Why Use Data Science In Finance

An important aspect that comes with the field of Data Science is the process of automation. In the financial industry as well, the need to autonomously carry out functions such as risk analytics in order to carry out strategic decisions for the company in real time is imperative. A momentary lag of making decisions in this kind of a time sensitive scenario can cause a ripple effect of negative impact across the entire industry sector.

Another example would be the management of customer data. The shire volume of data that is processed within a second, let alone within a day is nothing less than millions of bites in volume. If this was to be handled by traditional methodologies, the time lag of the deliverable would be high and the resulting impact from the insight generated is not time bound at all. This is where the common buzz word of Big Data Science come into play and does its wonders in wrangling and modelling large volumes of data.

Now that we have got a rough idea as to the importance of plugging Data Science into Finance sector, lets next direct our attention to few important and significant applications of Data Science impacting Finance.

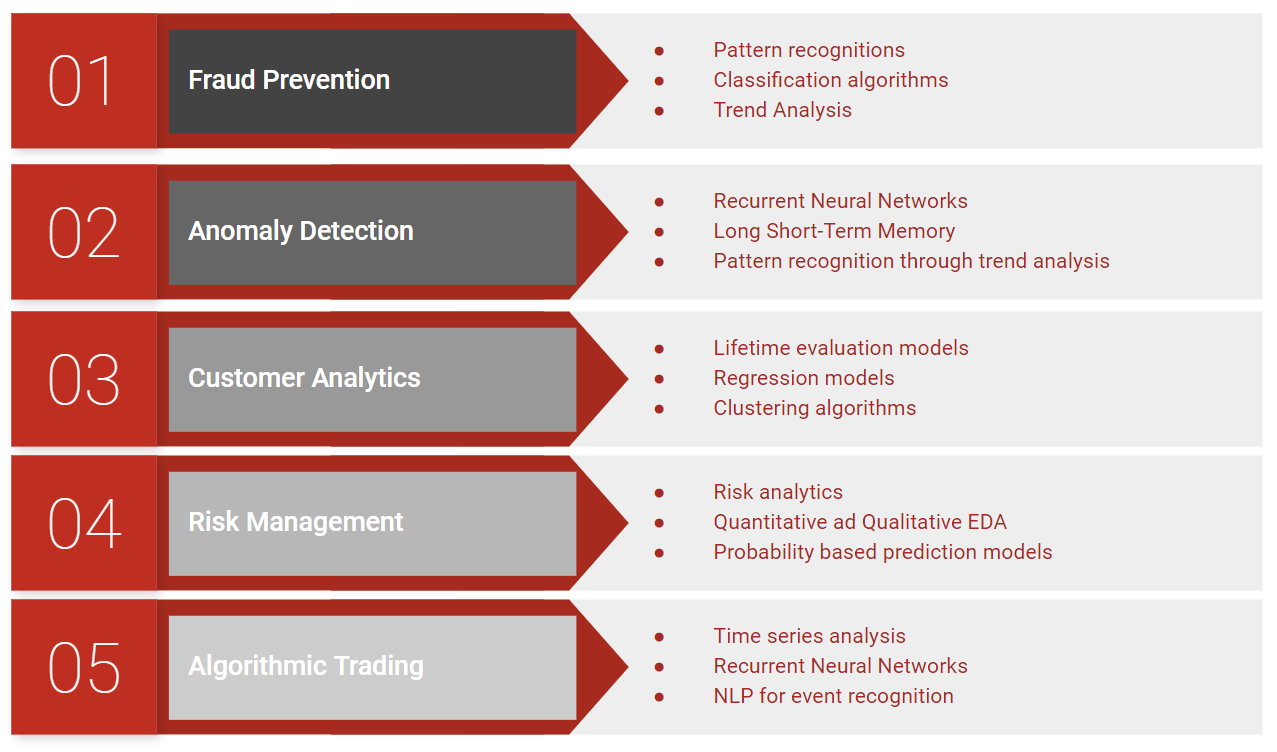

- Fraud Prevention

- Anomaly Detection

- Customer Analytics

- Risk Management

- Algorithmic Trading

Let’s go through each of the above items one by one in detail.

1. Fraud Prevention

Fraud prevention as the name suggests is the task of identifying any fraudulent activities in a financial trading. Examples of these would be identity theft and credit card schemes.

Some common scenarios of such fraudulent activities are generation of an unprecedented amount of transactions from an earlier identified conservative spender or it could be an out of region spending that denotes a purchase most often from a credit card that has been stolen and misused.

What is the role of Data Science in Fraud Prevention?

The most simple form of machine learning algorithm that utilizes random forest classifier is used as the foundation of much more complex fraud detection algorithms used today. What these types of algorithms do is identify whether there are significant factors to indicate abnormal activity in financial trading.

On top of this, the advancement of the IOT has brought in facial recognition and finger print scanners to add few more layers of security to the transactions. For instance, the facial recognition algorithms which usually run on convolutional neural networks, provide a real time indication of the person withdrawing money at an ATM.

Similarly, the pattern recognitions used in finger print recognition also require the use of variety of machine learning algorithms.

Thus, it is evident that the Data Science field has certainly contributed to the process of detecting any fraudulent activities across financial transactions as a whole.

2. Anomaly Detection

You must be wondering as to what is the difference between the aforementioned fraud prevention and this process of anomaly detection.

Well, in anomaly detection the goad is to pin point the root cause for the problem (or as it is implied detect the problem), whereas in fraud prevention, the prevention of fraudulent activities is emphasized.

The discretion of these two mainly resides due to the inability of recognizing an event as anomolous real time or instantaneously unlike the possibility in realizing a fraudulebt transaction as and when it happens. The occurrence of an anomalous activity would be highlighted with a certain time lag. A real life example of this is the identification of insider trading where the anomaly has already occurred, but the aftermath analysis now provides evidence of its occurrence.

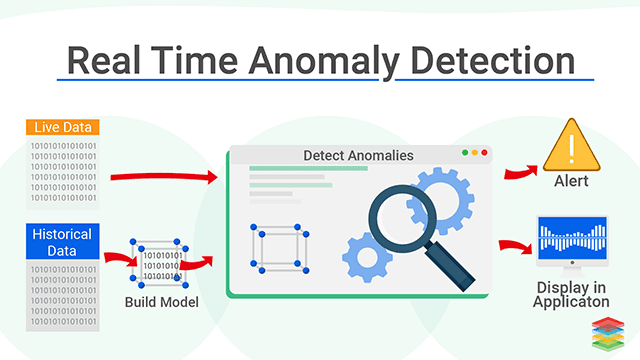

What is the role of Data Science in Anomaly Detection?

Before the dawn of data science the traders had already developed procedures to accurately predict the boom or collapse of a given equity. But the emergence of Data Science has shed some light in identifying what is not normal (an anomaly).

The use of deep learning in this is most renowned. Through the use of Recurrent Neural Networks and LSTM (Long-Short Term Memory) models, these anomaly detection models are built.

For instance, assume a certain organization is announcing the release of a new product or an upcoming merger. The anomaly detection algorithms would analyze the trends and patterns in trading prior and post of the internal announcement of the information that is not yet disclosed to the public.

Afterwards, based on the volume and regularity of the transactions, the anomaly detection model will identify as to whether a certain individual is utilizing non-public information to exploit the market.

Thus, it can be seen from this simple example that data science presents a significant impact on identification and prevention of anomalous trading that adversely affects the market as a whole.

3. Customer Analytics

It is important to financial institutions to have an overall understanding of their customers. Through the identification of the purchase and behavioral patterns of the clients, the institution can optimize their marketing campaigns and product launches to derive up economies of scale and subsequent revenue.

Based on historic data gathered from the transaction history and behavioral trends, financial institutions are able to derive predictions on each consumer’s future financial behavior. On top of these financial data, the use of other socio-economic and demographic characteristics can bring in the ability to group consumers into clusters and run certain algorithms on these clusters to come up with a approximate estimation of the income that is potentially generated by these customer groups in the future.

What is the role of Data Science in Customer Analytics?

In data science unsupervised machine learning techniques such as clustering and classification is used to group a cohort of selected individuals (customers of the financial institution in this scenario) into homogenous groups. The homogeneity can be based on a variety of variables of interest ranging from demograpgics such as age, income, gender, community affiliation etc. to other transactional variables such as credit worthiness, loan amounts due, purchase caps etc.

Then by building predictive models, it can be determined which of these features/variables are most significant for each group/cluster and depending on these insights an estimate of the worth of these clients can be identified. Also better target the marketing propaganda to suit each cluster separately.

4. Risk Management

An important aspect of any institution, let it be financial or otherwise, is the stability. The most important and closely related parameter that defines the stability of an organization is the manner in which it manages its risk.

Risk in its face can come in many different forms. Ranging from market uncertainty to an influx of competition to customer loyalty.

What is the role of Data Science in Risk Management?

This is particularly complex in tackling compared to the others because the manner in which risk presents greatly differs depending on the domain and thus, building a machine learning model to manage risk necessitates the knowledge diversified across many domains across finance, math, statistics and more.

An interesting article that details the manner in which Deloitte uses AI in credit risk management can be viewed here.

5. Algorithmic Trading

Algorithmic trading is simply the process of allowing machines to make trades on the market that is based on a machine learning algorithm. The machine is set to run a task on trading platforms within given regular intervals based on accumulated data.

A major upside to this is the prevention of the opportunity costs that prevails from foregoing a trading opportunity by hesitation or other human errors.

Mainly for these types of algorithms time series models becomes the stepping stone in later generating a large scale trading model.

Well, these were some of the areas that I believe are mainly impacted by Data Science when looking at the Finance domain.

Listed below is a summary of the Data Science techniques utilized in executing the aforementioned use cases in the finance industry:

Thank you very much for the time and interest shown folks. Happy trading … !!!

Comments